The Indian automotive industry is expected to reach US$300 bln by 2026 growing at CAGR of almost 11% since 2020.

One of the fastest growing segments in the Indian automotive industry is the passenger car. The Indian passenger car market was valued at US$32.70 bln in 2021, and it is expected to reach a value of US$54.84 bln by 2027, while registering a CAGR of over 9% between 2022-27.

The auto-component market in India is growing at CAGR of 3.28% and the industry is expected to reach US$200 bln by FY26. This industry accounts for 7.1% of India’s Gross Domestic Product (GDP) and employs as many as 5 mln people directly and indirectly.

The automobile repair industry is highly fragmented and is catered by both organised and unorganised players including OEM and multi-brand repair outlets.

While the potential looks very promising and encouraging, unfortunately, many players operating in this passenger car repair & service sector are forced to compromise with mediocre business results.

This contradiction (huge potential on one side vs. forced mediocre performance on the other side) triggered us to deep dive into this sector from various perspectives, including unique characteristics, key challenges, conventional approach, deadly vicious loop, unresolved conflict and commonsense approach etc. to solve the chronic problem.

Unique Characteristics of this Industry

While deep diving, one should be aware of the unique characteristics/insights with reference to this sector.

- Centres operating in this sector are closer to the ‘uncertainty of demand’ (both in parts & qty per parts) – unless they open the automobile for repair work & inspection – the work content is largely unknown.

- While the demand is uncertain – the customer expectations are certain.

- Service reliability (irrespective of parts reliability)

- Shorter lead time (irrespective of known/ unknown work content)

- Two necessary conditions to enable the service centres in meeting the above are;

- Service infrastructure (skill/bays/location etc.)

- Parts availability (irrespective of demand variability)

- While most of the service centres are able to easily manage the service infrastructure, maintaining the parts availability is continuing to be the a big nightmare!

- Range of parts that are forced upon to keep in stock are huge (5000~10000) towards meeting the customer expectations.

- Other than the consumables (<30%), most of the parts have ‘repair-driven- consumption’ which is unpredictable.

- If it is a non-company owned centre – most of the demands for these service centres are after the paid services (generally done by the OE service arm) – extent of the unknown is high (thanks to wear & tear of parts over the years).

- It is not uncommon to see a high number of WIP (opened automobiles pending repair work completion) – thanks to the unavailability of certain parts.

- Beware! even if one part is unavailable out of the required parts kit, service work cannot be completed!!

- In addition to service bays, high skilled mechanics are also tied up with incomplete works. The utilisation of skilled mechanics is poor as they wait for the missing parts.

- Above challenges force authorised service centres to compromise on customer expectations – at the cost of giving opportunities to freelancer mechanics/non-genuine parts.

- Repair & service capability is one of the significant influencers for the fresh sales of automobiles & genuine spare parts.

- When the success of any repair & service centre is measured as ‘profits made Vs. capital deployed in stocks, many are struggling without any ray of hope.

Key Challenges of this Sector

To meet the significant need of its customers (service reliability), players in this sector are forced to maintain the high availability of service parts in the midst of uncertain demand while the large range of parts adds fire to the fuel. Conventionally forecast is used as a planning mechanism to procure parts with an expected demand extrapolated from the past.

However, actual demand is known only at the time of opening up automobiles for service (baring consumables where prediction can work to some extent) and mostly actual demand varies from forecasted demand (variation of the forecast is directly proportional to the forecasting horizon). The difference between actual demand vs. forecasted demand ends up either as excess stocks or stockouts.

While the excess stock has negative ramifications like capital blockage, space blockage, aged inventory (don’t be surprised to see some parts over years), inadequate money to buy fresh parts (which are stocked out), etc., the stock-outs also lead to delay in servicing, locking the key resources impacting their productivity (mechanics/service bays), high WIP of incomplete jobs, firefighting with multiple emergencies/ customer escalations, cascading delays for subsequent jobs, etc.

Resultant poor customer service in authorised service centres opens up parallel & non-official service centres unavoidably. Ease of access and timely/early completion of repair works (with/without genuine parts) encourage more customers to distance away from the authorised service centres leading to future loss of service opportunities.

One of the popular (and failed) attempts to prevent customer erosion is to restrict the supply of genuine parts to the open market by the OEMs. Unfortunately, part’s vendors convert this as an opportunity and create a parallel network to serve the aftermarket directly (at times at competitive prices) thereby defeating the sole purpose.

Loss of sales & opportunities due to unavailability of parts forces these players to improvise the parts procurement planning, meaning better forecast for the future, meaning, back to square one!

This puts these players operating in auto repair and service sectors, in the below deadly spiral.

When we went deeper with the Theory of Constraints (TOC), thinking framework, we understood what is holding (unresolved conflict) these auto repair & service companies into the above spiral forever.

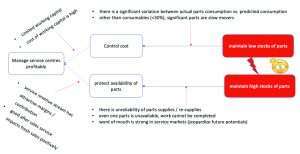

The Un-resolved Conflict

The two necessary conditions to meet the common objective of most of these auto repair & service companies are;

- Protect availability of parts.

- Control cost.

But surprisingly, the actions to meet these respective conditions are in direct conflict with each other (as described in the above logical diagram, referred to as conflict cloud, one of the logical tools of thinking process application, Theory of Constraints).

Conventionally the conflict is taken for granted and hence the only way to meet both the necessary condition was to assume that the “repair-driven-demand” can be predicted using forecast. (And hence, the deadly vicious spiral, we discussed above).

But, when we challenge the long-held assumption that the “repair-driven demand” can be predicted, then, oceans of opportunities open up in front of us.

Resolving the Conflict

- Can we ponder some of the key points challenging the assumption (s)?

- Can the demand be predicted? (especially failure driven demands?)

- Should we react to the unknown demand (forecast based procurement)?

- Should we respond to the unknown demand (consumption-based ordering)?

- Does the forecasting error reduce with reduction in the forecasting horizon?

- Does the forecasting error reduce with the aggregation of stocking nodes?

- Should all the parts be stored in service centres or high fast movers only?

- Should the upstream stocking node (Central/ Regional hubs) operate as transit point/holding point?

- When stocks are held at central/regional hubs (aggregated) – what would be the impact of supply lead time to centres?

- When stocks are held at central/regional hubs (aggregated) – what would be the quantum of stocks to be kept in service centres?

- Should we measure the supply efficiency as fill rate or with reference to actual level of stocks Vs. designed level?

Inherent Potential

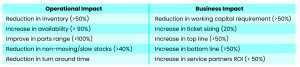

Service centres who have successfully resolved the above conflict, are advantageously placed to capture the inherent and upcoming potentials, both in operational and business parameters, including the below;

Sources

https://www.grandviewresearch.com/industry-analysis/india-automotive-marketwww.ibef.org https://www.ibef.org/industry/autocomponents-india

Authors

Visweswaran Sundararaman, BE. MBA, MS (USA).

Principal & vertical Head (manufacturing & distribution)

Trained & certified in thinking & application of Theory of Constraints (TOC)

Akshat Agrawal, BE. PGPM

Akshat Agrawal, BE. PGPM

Project Director

Trained & certified in thinking & application of Theory of Constraints (TOC)