Finance Minister Nirmala Sitharaman presented the Modi government’s final full-fledged Budget on February 1. Although the budget does not offer much relief to the sector, there are a few other measures that could potentially foster industry growth. Keep track of this blog to stay informed on how the auto sector reacted to this year’s Union Budget.

“The budget is a blueprint of a digitally enabled, Aatmanirbhar Bharat, coupled with measures that will drive sustainable yet inclusive growth at a rapid pace. Focus on exports, manufacturing, local value addition and encouraging green energy & mobility are indeed steps in the right direction. Further, the proposals for personal Income Tax will put more money in the hands of people thus fuelling consumption and leading to economic growth.”

Sunjay J Kapur, President ACMA & Chairperson, Sona Comstar

“Apart from being growth oriented and inclusive, the thrust given in the budget towards green energy and mobility is indeed very encouraging. Measures for promoting li-ion cell manufacturing, scrapping of Government vehicles, focus on Hydrogen, Ethanol Blending and Bio Gas among others are the right steps towards realising our Hon’ble Prime Minister‘s Vision of a Carbon Neutral India by 2070.”

Vinnie Mehta, Director General, ACMA

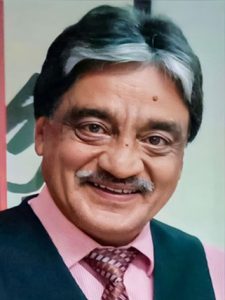

“The Modi Government’s last full budget has been populist in all aspects as it will help boost  Auto Sales all around. While the capital outlay of ₹10 Lakh Cr in intra spending will definitely aid CV sales, the aim to scrap all old government vehicles by aiding State Governments will boost all segment sales. Apart from this, the reduction in individual tax slabs will benefit the ailing entry level 2W and PV segment. Reduction in highest tax surcharge from 37% to 25% will also benefit luxury vehicle sales. With focus on Electrification, relaxation on import duties of Lithium ion batteries will help in price reduction of EVs, thus make it affordable for the masses. On business front, being part of the MSME universe, cost of credit guarantee will reduce by 1% thus helping Auto Dealers in raising funds. The budget has also focussed on ease of doing business by reducing more then 39K compliances and enabling entity level digilocker for storing and sharing documents.”

Auto Sales all around. While the capital outlay of ₹10 Lakh Cr in intra spending will definitely aid CV sales, the aim to scrap all old government vehicles by aiding State Governments will boost all segment sales. Apart from this, the reduction in individual tax slabs will benefit the ailing entry level 2W and PV segment. Reduction in highest tax surcharge from 37% to 25% will also benefit luxury vehicle sales. With focus on Electrification, relaxation on import duties of Lithium ion batteries will help in price reduction of EVs, thus make it affordable for the masses. On business front, being part of the MSME universe, cost of credit guarantee will reduce by 1% thus helping Auto Dealers in raising funds. The budget has also focussed on ease of doing business by reducing more then 39K compliances and enabling entity level digilocker for storing and sharing documents.”

Manish Raj Singhania, President, FADA

“The 2023-2024 Union Budget is welcome and leads us towards a cleaner and more sustainable mobility solution for a greener and cleaner India. This budget highlights significant positive initiatives for the automobile industry through a slew of announcements supporting state government and municipalities in scrapping pollution-causing vehicles. The scheme makes way for faster electric vehicle adoption and helps transition to cleaner mobility in the long run. Along with that, the prioritization of green growth will aid all energy-generating sectors – wind, hydro and solar. The national green hydrogen mission, which was recently launched with an investment of ₹19,700 Cr will help the economy transition to low carbon intensity and reduce reliance on fossil fuel imports which would help guide the industry’s services toward smart logistics of the future. The increased outlay for infrastructure will also assist the transportation sector as a whole with a positive effect on logistics, light vehicles, industrial vehicles and commercial vehicles.”

budget highlights significant positive initiatives for the automobile industry through a slew of announcements supporting state government and municipalities in scrapping pollution-causing vehicles. The scheme makes way for faster electric vehicle adoption and helps transition to cleaner mobility in the long run. Along with that, the prioritization of green growth will aid all energy-generating sectors – wind, hydro and solar. The national green hydrogen mission, which was recently launched with an investment of ₹19,700 Cr will help the economy transition to low carbon intensity and reduce reliance on fossil fuel imports which would help guide the industry’s services toward smart logistics of the future. The increased outlay for infrastructure will also assist the transportation sector as a whole with a positive effect on logistics, light vehicles, industrial vehicles and commercial vehicles.”

Suresh KV, President & Region Head, ZF India.

“We welcome the Union Budget 2023 and its larger vision of promoting green growth. The budget focuses on capital expenditure as well as promoting consumption. It also offers steps to boost domestic manufacturing and encourage green energy, and mobility. The announcement of ₹35,000 Cr fund to support green projects will give a massive boost towards India’s net zero goals. Additionally, the Green credit programme, will further encourage responsible companies to take more environmentally sustainable and responsible actions. All these steps are also going increase the jobs in these sectors. We are particularly encouraged by the push that the budget is likely to give to the auto sector in the form of Vehicle Replacement policy which will allow States in replacing old polluting vehicles. This will in turn benefit auto sales and electric vehicles. We look forward to understanding the FM’s proposal to reduce basic customs duty on some goods from 21% to 13%, including lithium and ion cell batteries used in EVs. Overall, this is an inclusive budget that also stands to further boost Atmanirbhar vision.”

“We welcome the Union Budget 2023 and its larger vision of promoting green growth. The budget focuses on capital expenditure as well as promoting consumption. It also offers steps to boost domestic manufacturing and encourage green energy, and mobility. The announcement of ₹35,000 Cr fund to support green projects will give a massive boost towards India’s net zero goals. Additionally, the Green credit programme, will further encourage responsible companies to take more environmentally sustainable and responsible actions. All these steps are also going increase the jobs in these sectors. We are particularly encouraged by the push that the budget is likely to give to the auto sector in the form of Vehicle Replacement policy which will allow States in replacing old polluting vehicles. This will in turn benefit auto sales and electric vehicles. We look forward to understanding the FM’s proposal to reduce basic customs duty on some goods from 21% to 13%, including lithium and ion cell batteries used in EVs. Overall, this is an inclusive budget that also stands to further boost Atmanirbhar vision.”

Nirmal K Minda, Chairman & Managing Director, Uno Minda Ltd.

“33% increase in capital outlay with an effective provision of ₹13.7 lakh crores will spur growth in the economy resulting in positive impact on the Auto sector. The Auto industry is fully aligned with the initiatives on Sustainability and Decarbonisation and increased focus on Hydrogen, Ethanol Blending, Bio Gas, Electric Vehicles and Battery Storage. Announcement for funding various Government Departments for replacement of old vehicles is also commended. Another appreciable feature of the budget is putting more money in the hands of the individuals by some lowering of effective personal income tax rates that should increase consumption and consequently lead to more demand. All in all, this is a growth-oriented budget with positive impact on the Auto Sector.”

Vinod Aggarwal, President, SIAM and MD & CEO, VECV,

“We at Sirius Cleantech are delighted with the Green growth approach to the budget. It is encouraging to the EV industry that the government are implementing many programmes for green growth across various economic sectors. Batteries have been a major component that have been inflating the cost of EV’s and the reduction of customs duties on capital goods imported for the manufacture of Lithium-ion batteries is welcome. This is a great boost to the manufacture of batteries in the country and will boost the creation of the domestic EV ecosystem taking us towards self-reliance in this area.”

Wayne Ferrao, Chief Strategy Officer, Sirius Cleantech Private Ltd.

“We, at Henkel India, are happy that the Hon. Finance Minister has adopted 7 priorities in the well-organised union budget for FY2023-24, which include inclusive development, green growth, youth power, financial sector, and last mile infrastructure. The strong continuity for Capital expenditure investment programmes into roads, railways, ports, airports will have a strong growth multiplier impact and ensure a higher rate of employment. The simplified tax structure and the raising of the tax exemption slabs are welcome as it puts more money in the hands of the consumer. We also appreciate the reduction in basic custom duty rates on goods other than textiles and agriculture, from 21% to 13%. Sustainability is one of our key strategic pillars at Henkel, and we are delighted that the government has reinforced investments in green hydrogen, clean energy storage and transmission, which are the key drivers of the government’s “Green Growth” priority sectors. We also welcome the green credit programme that will be notified under the Environment Protection Act.”

S Sunil Kumar, President, Henkel India

“Union Budget 2023-24 is aligned with the Prime Minister’s vision of building a competitive and resilient India, with inclusive growth. The budget emphasises comprehensive national infrastructure development and expands on the digitization of the economy. The road transportation sector plays an important role in national development and would have an even more impactful role, going forward, in supporting the Government’s vision. The announcement that old vehicles owned by the central government and state governments will be replaced as part of the vehicle scrapping policy presents a significant opportunity for fleet modernisation. This budget also echoes our sentiment and commitment to clean energy vehicles for a cleaner and greener future, as part of a national mission to achieve the net zero carbon emission goal.”

Dheeraj Hinduja, Executive Chairman, Ashok Leyland

“We welcome the budget shared by Hon. Finance Minister. It is a promising budget for the EV sector as it showcases the government’s dedication to promoting environmental sustainability. The major announcement of reduction of GST on Li-ion battery from 12% to 5% is a noteworthy change as it will bring down electric vehicle costs thus ensuring India’s vision of complete electrification of transport in the country by 2030. The industry has aligned it’s policy’s to work in conjunction with the governments idea. The current budget has brought good vibes to the entire EV industry and we are hopeful that we get this continued support from the government to help us change the way India travels and for newer green mobility solutions. The announcement of creating 5cr jobs by 2036, is a positive step which will enable the country to generate a new breed of visionaries who will be ready to change the Electric Vehicle universe.”

Sagar Joshi, Founder & CEO, KICK-EV and AUTO i CARE

“We applaud the FM’s vision of making India a pollution free country through sustainable practices. The focus on reducing carbon footprint and high pollution levels certainly found focus in the Budget 2023 as it places a strong emphasis on making a greener India. We welcome the government’s decision to grant state governments assistance in replacing outdated automobiles under the ‘Vehicle Scrappage Policy’. The foundation for ELV recycling was laid down two years ago by Hon’ble Prime Minister, Narendra Modiji and further well supported by Nitin Gadkariji, Minister of Road Transport and highways of India, under the ‘Vehicle Scrappage Policy’ initiated by Niti Ayog. This is a positive step towards making the planet greener and recycling can achieve the objective of keeping materials out of the landfill by obtaining important metals such as steel, iron, aluminum and copper through recycling the old vehicles, which can be used again to manufacture new products.”

“We applaud the FM’s vision of making India a pollution free country through sustainable practices. The focus on reducing carbon footprint and high pollution levels certainly found focus in the Budget 2023 as it places a strong emphasis on making a greener India. We welcome the government’s decision to grant state governments assistance in replacing outdated automobiles under the ‘Vehicle Scrappage Policy’. The foundation for ELV recycling was laid down two years ago by Hon’ble Prime Minister, Narendra Modiji and further well supported by Nitin Gadkariji, Minister of Road Transport and highways of India, under the ‘Vehicle Scrappage Policy’ initiated by Niti Ayog. This is a positive step towards making the planet greener and recycling can achieve the objective of keeping materials out of the landfill by obtaining important metals such as steel, iron, aluminum and copper through recycling the old vehicles, which can be used again to manufacture new products.”

Shashank Soni, Director, ELV Recycling Private Limited

“The changes in the Income tax slab structure has enhanced the purchasing power of the populace. This move will encourage the adoption of cleaner, cost effective means of travel for their daily commute and the availability of FAME-II subsidy will further boost the sales of electric vehicles in the coming fiscal. Additionally, the extension on customs duty on the import of capital goods and machinery for developing lithium-ion cells would also enable EV manufacturers to localise their products in the long term, leading towards reduction in the cost of an electric vehicle for the consumer in the years to come, particularly for a brand like ours that are 95% indigenously manufactured in India.”

Kapil Shelke, Founder & CEO, TORK Motors

“The Union Budget 2023 should drive demand as it focuses on boosting consumption by increasing the disposable income of taxpayers. Further, an increased capital expenditure on infrastructure, particularly roads, should also create demand for the automotive sector. The change in basic custom duties is however going to impact the pricing of some of our select cars like the S-Class Maybach and select CBUs like GLB and EQB, making them dearer. However as we locally manufacture most of our models, this will not affect 95% of our portfolio. The focus on sustainability in the budget is commendable and initiatives like extending customs duty exemption of capital goods and machinery to manufacture lithium-ion cells for EVs is a step in the right direction, as it will consistently drive green mobility in the country.”

Santosh Iyer, Managing Director & CEO, Mercedes-Benz India

“I am pleased with our honourable Finance Minister‘s initiatives. The announcement that “Battery Energy Storage with a capacity of 400 MWH would be supported by viability gap funding” is a significant step forward in the co-development of the battery swapping and EV charging ecosystem. National Green Hydrogen Mission will also help to facilitate the transition of the economy, reduce dependence on fossil fuels leading to the growth in the market of technology. Given the budget’s stated goal of encouraging more environmentally friendly modes of transportation, the announcement of ₹35,000Cr for the energy transition initiative is encouraging news for the EV sector. It demonstrates the government’s intention to prioritise “green growth,” which focuses on new technology development.”

Ashutosh Verma, Founder, Exalta

“We welcome the initiatives outlined by the Hon’ble Finance Minister in the Union Budget 2023–24,” Chugh remarked in response to questions about the next budget. In light of the budget’s stated goal of encouraging more environmentally friendly forms of transportation, the announcement of ₹35,000Cr for the energy transition initiative is encouraging news for the EV sector. Although the union budget did not emphasise the traditional auto industry, it did demonstrate the government’s intention to prioritise “green growth,” which emphasises the development of new technology. The substantial boost and positive step toward co-development of the battery swapping and EV charging ecosystem provided by the announcement that “Battery Energy Storage with a capacity of 400 MWH would be supported by viability gap funding” is a result of the Finance Minister‘s declaration. This kind of action is crucial to bolstering the EV market.

MS Chugh, Founder &Chairman of Aponyx EV

It is really great to see how environmental sustainability has been one of the top 7 priorities in this budget. The Pro-EV budget focuses on much-needed initiatives such as Customs Duty reduction from 21% to 13% on capital goods and machinery required for Lithium Batteries and an extension of the subsidies on EV batteries for one more year. This will certainly encourage each EV manufacturer to contribute to Government initiatives to achieve mass EV adoption by 2030. This will also encourage investments in the EV sector which help new players to continue with innovation.”

Anmol Bohre, Co-founder & Managing Director of Enigma

“Auto and auto service sector have been facing various challenges. In the current scenario when new age entrepreneurs are trying to explore businesses in unorganised sectors like auto services or similar, it becomes difficult to follow procedures of traditional business, as it comes at a cost, and you only have so much bandwidth in terms of resources. Therefore, we value a lot that the budget has taken the same into consideration and by reducing more than 39,000 compliance it has made an effort to add to the ease of doing business in India. Additionally, the tax benefits on their incorporation is being extended by another year and the carry forward of losses to set off against future profits will now be allowed for 10 years instead of 7 years, which is going to provide a lot of relief to startups.”

Mridu Mahendra Das, Co-founder & CEO Automovill

“The Budget 23-24 addressed by Finance Minister Nirmala Sitharaman reinforces the excellence of the Budget introduced last year. The Union budget correctly emphasised the need for a greater accentuation on innovation, research, and development, which are vital to India’s ambitious goal of becoming a US$5 tln economy. A special proposal to establish three AI centres will motivate entrepreneurs aiming to launch AI startups. Moreover, it is worth mentioning that the planned infrastructure target is aligned with broader environmental and social goals. Like the rest of the startup community, we fully embrace the Budget 2023.”

Dhananjaya Bharadwaj, Co-founder and CEO, ParkMate

“In the last year alone, EV Sector has seen many ups and downs. At present, EVs contribute to only 2% of the total auto sales in India and extensive support from the government is required to chalk out sustainable growth of the sector. To achieve the ambitious mission of e-mobility in India, initiatives announced in the Union Budget this year including – Customs Duty reduction from 21% to 13% on capital goods and machinery for Lithium Batteries, and an extension of the subsidies on EV batteries for one more year are going to help. These will certainly encourage each EV manufacturer to contribute to the industry initiatives to achieve mass EV adoption by 2030.”

Muzammil Riyaz, Founder, EVeium Smart Mobility

“Auto sector in India has been struggling for way too long. It was expected that the foray of EVs will give a new life to the players, however, the sector continues to suffer from initial ownership costs and other factors. The penetration of EV brands and the adoption of the new technology seems to be taking time. Amidst this, the announcement by Hon’ble FM to replace old government vehicles will certainly play a game changer for the sector. Additionally, an Indirect tax proposal can certainly fuel the exports which will lift the auto economy immediately, as manufacturing here is competitive on the global stage. Furthermore, manufacturing lithium-ion battery has been a challenge for EV players, and it was the first ask of EV players to have customs duty exemptions on the import of capital goods and machinery required for lithium-ion batteries. Overall the budget has certainly taken steps to revive the sector”,

Mukesh Taneja – Co-founder & CEO, GT Force

“The Union Budget 2023-24 is pro-development, with sustainable planning; energy transition for a cleaner tomorrow and inclusive growth through tech-enabled economy at its core. Moreover, the impetus on the EV sector in budget is quite encouraging for all Industry players. Drawing from its core, the decision to exempt Lithium-ion cells of custom duties for another year is a welcome move, as its majorly impacts the affordability of EVs in India. Furthermore, the viability gap funding announced to support the Battery Energy Storage Systems, along with a framework of Pumped Storage Projects, is designed to reduce the revenue required to recover costs and offer better returns, especially for the Private sector.”

Anshul Gupta, Managing Director, Okaya Electric Vehicles

“A commendable Budget by the Hon’ble Finance Minister. In line with our expectations, #Budget2023 has focused on incentivising state governments for infrastructure development. The Centre’s support with enhanced outlay of ₹1.3 lakh crore will definitely act as the accelerator toward logistics policy creation at the state level. With this in place, we are hoping to see good traction in transportation infra creation, especially related to top freight routes, logistics parks and highways development. Additionally, opening opportunities for private investments in infra will pump in efforts toward roads, urban infrastructure and power sector developments, which are critical for efficient transportation and transition to green mobility. We also welcome the decision to extend the income tax benefits for start-ups and the formation of the National Data Governance Policy. These were much needed given the market dynamics and the fast-emerging start-up ecosystem.”

Karan Shaha, Co-founder and CEO, Vahak

“This is an outstanding budget as it is disciplined, growth-oriented, inclusive and sustainable. The Finance Minister has done a commendable job by tabling a budget that is big on consistency and driven majorly by capex. The steep increase in capex, to the tune of ₹10 lakh crore, will ensure the continuum of cyclical recovery. Capex spending is good because it has a higher multiplier effect: every rupee spent on capex has a multiplier of ₹3 as compared to just about ₹0.9 for revenue expenditure. That apart, higher capex also creates jobs in the hinterland. The focus on core infrastructure, including increased funding for railways and clean energy, as well as the government’s ambitious plans for the agricultural sector, will help to improve rural incomes. Above all, it is encouraging to see the government setting the pace for climate action by announcing a “green budget” that will pave the way for a greener, cleaner planet.”

Anish Shah, Managing Director & CEO, Mahindra Group

“A Closer Look at the Impact of the Indian Budget on the EV Industry; In India, the Union Budget is a highly anticipated annual event due to its influence over the nation’s economic policies and its impact on various industries. This year, the Government of India has taken a big step in favour of the electric vehicle (EV) industry with the introduction of numerous incentives. In this blog post, we’ll take a closer look at the budget’s impact on the EV industry and discuss some of the measures the government has taken to encourage the transition to cleaner forms of mobility.”

Darshan Rana, Chairman and Managing Director, Erisha E mobility private limited

”The budget this year has brought a lot of promise to the auto industry especially the EV sector. Main focus on reduction of import duties on Li-Ion battery components will benefit the EV industry immensely. This is in line with the objective to boost domestic manufacturing, domestic value addition and green energy. Continued support to the vehicle scrappage policy will surely be in favour of companies like GoGoA1 who are into retrofitting of older vehicles to convert them into EV’s. We were hoping for reduction on GST of other components which are used to make EV retrofit kits, which would have brought the cost down more. We are looking forward to working closely with the government policies to help the country and the EV industry.”

Shrikant Shinde, Founder & CEO, GoGoA1

“We at Ipower welcome the government initiative of scrapping the custom duty on capital goods/machinery for the manufacture of lithium-ion cells for use in batteries of electrically operated vehicles (EVs). This will for sure help in increasing the adoption of EVs. This will allow new cell manufacturing facilities to grow their presence and encourage new players to enter the market. With this budget, the Government of India has presented a clear message that how strongly India is looking to achieve Net Zero. Lithium batteries are going to play a very important role in the same.”

Vikas Aggarwal, Founder & MD- Ipower Batteries Pvt Ltd

“The Union Budget for 2023-2024 has a strong focus on green growth and sustainability. The “Green Growth” priority sector is a step towards India’s resolve to achieve Net Zero by 2070. The government has granted infrastructure status to the EV sector, paving the way for easier access to credit for companies making EV components. This will reduce production costs and help expand India’s manufacturing capabilities in this sector. The scheme announced to scrap old vehicles and replace the old polluting vehicles will encourage more people to switch over from petrol/diesel cars to electric ones. The Indian Government is committed towards introducing green mobility solutions such as e-rickshaws, e-bicycles and other clean energy transport systems in cities across the country with an emphasis on green growth with focus on green fuel. We are delighted to see such initiatives included in the Union Budget 2023.”

Tushar Choudhary, Founder & CEO, Motovolt Mobility

“The emphasis on green growth and net-zero emissions is the need of the hour as outlined in the Union Budget. The outlay of 35,000 crore for priority capital investments towards energy transition and net-zero goals will boost energy security in India. Further, the decision to support Battery Energy Storage Systems with a capacity of 4,000 MWH with viability gap funding will give a huge impetus to the clean energy sector. One of the most impactful decisions this time is the extension of customs duty exemption for import of capital goods and machinery required to produce lithium-ion batteries for EVs in India. This move will reduce the initial capital investment needs for the battery manufacturers and is also likely to make the batteries become cheaper as there will be a larger manufacturing base for them. Concession on duty on lithium ion cells import for EV batteries has also been extended for another year, which would lead to greater EV adoption in 2023. Similarly, basic customs duty exemption on raw materials required for manufacturing of nickel cathode used in the batteries has also been continued. Improving the ease of doing business by reducing 39,000 compliances, and the decision to provide greater funding to state governments to replace old polluting vehicles are also welcome steps. It is expected that these old vehicles will be replaced with EVs and that would improve their adoption in the country. The establishment of 100 National Skill Development Centers will ensure that a larger number of youth across India are trained on advanced technologies and made ready to work in the climate-tech sector. All these are great initiatives, and if this momentum is further supported by the unveiling of the final draft for the Battery Swapping Policy, we will be able to witness accelerated growth of clean mobility in India.”

Varun Goenka, CEO & Co- Founder, Chargeup

“The Government’s proposal to increase the capital expenditure outlay by 33% is a welcome move as this will directly impact the logistics and mobility sectors. These sectors would also grow as they expand to serve the enhanced demand for goods generated by new infrastructure projects. The Finance Minister’s statement on replacing old government vehicles will increase the demand for new vehicles and we are committed to supporting the OEMs meet this demand.”

Stefano Sanchini Managing Director, Bridgestone India

“The Green Credit Programme that will be notified under the Environment (Protection) Act is a great step towards driving positive behavioural change. This will incentivize companies, local bodies, and individuals to take environmentally sustainable and responsive actions and help mobilise additional resources for such activities. Relief from customs duty on the import of lithium-ion cells for batteries for another year is definitely a big support.”

Khushboo Sachdev, Director – Su-vastika, an EV Inverter